From tractors and harvesters to hay balers and plows, the right equipment can make all the difference in maximizing yields and minimizing labor costs. But purchasing new — or even used — equipment outright can be extremely costly for farmers.

Farm equipment loans can help farmers buy the equipment they need to improve efficiency in their operations — without putting a strain on current budget or cash flow.

FBN Finance is a trusted provider of agricultural financing solutions, including farm equipment loans. We have a team of experts with years of experience in the industry, and we understand the unique needs of farmers.

When farmers work with FBN Finance, they can expect a seamless and streamlined online application process before being connected with a dedicated loan advisor who will guide them through the process from start to finish. With great rates and flexible repayment terms, FBN Finance applies a Farmers First® mindset to help qualifying growers and producers get the equipment they need to run a successful ag operation.

Terms

FBN equipment loans have terms of up to seven years and require:

A minimum loan amount of $10,000

As little as 0% down payment (monthly)

Instant Approvals

With instant approval* on equipment loans from FBN Finance, farmers can get an instant decision to expedite financing and be more competitive in a seller’s market.

With an instant approval*, farmers can likely receive funding faster because they don’t have to fill out lengthy application forms or wait weeks for paperwork to be reviewed. This is especially critical for farmers who need urgent funding to purchase equipment and get back to running their farm.

Farmers can apply virtually anywhere by using a laptop or phone. This is a huge advantage for those who don't have the time to travel to the bank.

Interested in financing other areas of an operation? FBN Finance also offers instant approvals* for qualified farmers on operating lines under $1 million and land loans up to $2.5 million.

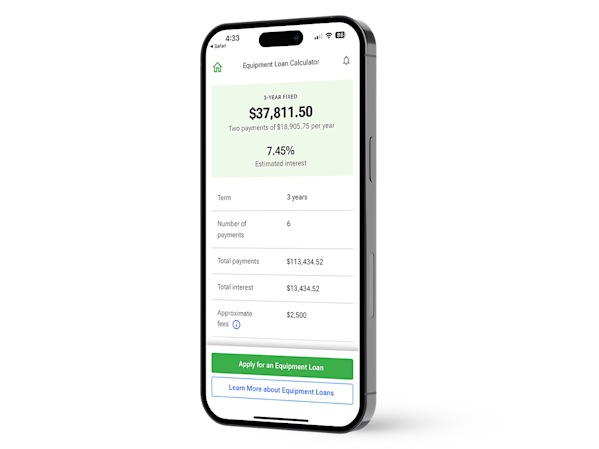

Calculate Your Equipment Loan Payment

Adjust the loan amount and credit score to see personalized loan options.

What Is an Equipment Loan?

What Can Equipment Loans Be Used For?

Equipment loans can be used to finance a wide range of farm equipment, including tractors, combines, irrigation systems, and more. These loans can also be used to purchase either new or used equipment, depending on the borrower's needs. For example, equipment loans can be used to:

Purchase new or used tractors, combines or other farm equipment

Upgrade or replace existing equipment

Purchase irrigation systems or other farm infrastructure

Finance equipment repairs or maintenance

How Can Farmers Qualify for an Equipment Loan?

To qualify for an equipment loan, farmers typically need to have a good credit score and a solid financial history. There may also be minimum requirements for the amount of the loan and the type of equipment being financed.

In most cases, farmers will need to provide proof of 3-5 years of Schedule C or F income. Equipment loans are typically secured by the equipment itself, meaning that if the borrower defaults on the loan the lender can repossess the equipment.

What Documentation Is Required to Secure an Equipment Loan?

To secure an equipment loan, farmers will typically need to provide documentation that could include financial statements, tax returns, and proof of insurance. The specific requirements may vary depending on the lender and the type of loan being applied for.

Ready to Apply for an Equipment Loan from FBN Finance?

Ready to Apply for an Equipment Loan from FBN Finance?

If an equipment loan sounds like the right fit for your ag operation, complete the form on this page or call 866-551-3950 to speak directly with a member of our FBN Finance team today.

More Financing Solutions from FBN Finance

Operating Lines

Insurance

Crop Marketing

Flexible Input Loans

Our Latest FBN Financial Insights

When Should You Lease vs. Buy Farm Equipment?

Where to Find Farm Equipment for Sale

What Is a Farm Equipment Loan?

Which Equipment Ownership Metrics Should You Consider?