3-Year Variable

| Loan Option | Interest Rate |

|---|---|

| 1-Year Variable | |

| 5-Year Variable | |

| 7-Year Fixed | |

| 15-Year Fixed | |

| 20-Year Fixed | |

| 25-Year Fixed | |

| 30-Year Fixed | |

Great Rates

Compared to other ag mortgage lenders, we often help farmers save thousands with great rates, low overhead, and national member network.

Quick Decisions

Save time and money with our secure and simple digital application, speeding up the approval process so you get a decision in days instead of weeks.

Industry Experience

Our FBN Finance loan advisors — many of whom are producers themselves — have a deep understanding of ag and are ready to develop personalized solutions for your farm.

What Is a Farmland Loan?

What Can Farm Land Loans Be Used For?

Farmland financing is not limited to purchasing land. It can also be used to finance any improvements on your farmland, including:

Construction of barns, silos, livestock facilities, and outbuildings

Installation of grain storage

Hunting ground for recreational use

Farmland loans also allow you to purchase new farmland, refinance existing debt on your property for a lower interest rate, or access additional financing by borrowing against your land.

How to Apply for a Land Loan

At FBN Finance, we strive to make the loan application process as streamlined and simple as possible. Get customized financing in four steps:

1. Submit an Application

2. Receive a Decision

3. Value Your Farmland

4. Get Funded

Required Documentation

Initial Documentation:

Driver’s license or government-issued ID

Entity documents, if applicable

Current balance sheet for all borrowers and entities

1 year of tax returns for all borrowers and entities

Legal description / parcel ID on all land to be used as collateral

Supplementary Documentation (Needed upon Request):

Projection / crop budget

Crop insurance information

Verification of liquid assets and liabilities from the balance sheet

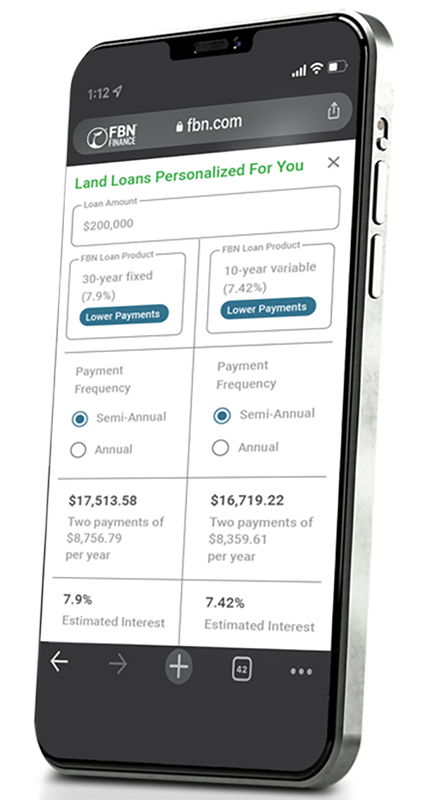

Estimate Your Farmland Loan Payments

By estimating rates and fees up front, our free calculator helps you effectively plan and strategize your financial options for future land purchases. Just provide a few basic details and the FBN Finance Farm Land Loan Calculator will automatically calculate multiple loan choices customized for you.

Access Free Educational Resources

Is It Better to Rent or Buy Farmland?

7 Steps to Purchasing Your Ideal Farmland

Before You Buy: 4 Farmland Factors to Consider

How to Find Farmland for Sale

10 Questions to Ask Before Buying Farmland

Ag Land Loans 101

Succession Planning 101

Finance Resource Library

FAQs

What is the payment schedule for my land loan?

Loans can be made on a monthly, semi-annual, or annual basis. Prices shown here are based on semi-annual payments. Annual payments increase the interest rate by 0.15%.

Is there a penalty for paying off my land loan early or refinancing it?

No. There is no prepayment penalty.

What fees from FBN Finance are included in my loan?

Your loan will have title fees, appraisal fees, and an origination fee. In most cases, these fees are less than 1% of the loan value. For many refinance loans the fees can be added to the loan itself, so you don’t have any out-of-pocket costs at closing.

Title fees and appraisal fees are passed on to the applicant at cost. If you have a current land appraisal that is less than one year old, you may be able to reuse it, subject to some restrictions. FBN Finance’s origination fee varies by loan size, and can range between 0.3%-0.65%.

How long is the approval process for land loans with FBN Finance?

With other lenders, waiting for a decision on a loan application can take anywhere from five to 10 business days. That waiting period can be stressful and cause delays in important decisions for your operation. With FBN® Finance, however, the application process is much quicker. You'll hear back from a member of our team within 48 business hours.

Who will I be working with if I finance with FBN Finance?

You will work with one of our Loan Advisors as well as our team of credit analysts and loan closers.

Will FBN Finance be there for me for the life of my loan?

While we work with multiple financing partners to fund your loan, for the vast majority of the loans we are your first point of contact for any potential issues that may arise. You'll receive billing statements and other communications from us, will process your payments through us, and contact us for any questions that might arise during the life of your loan.

What type of land do you finance?

We finance land that is used for agricultural purposes. These property types include farms, ranches, bare land, timberland and hunting land as well as improvements.

What is the minimum acreage required?

Your land must be a minimum of at least 10 acres.

What is the loan amount requirement?

The minimum loan amount is $150,000 with no restriction on the maximum requested.

Where can I find farmland?

You can find farmland across the country. Use AcreVision, FBN’s free digital farmland evaluation tool, to find land with the click of a button. See our dedicated California, South Dakota, and Texas pages for state-specific loan information, or contact a member of our team to inquire about financing land in other states. You can also download our free guide “How to Find Farmland for Sale” to discover six ways to find farmland for sale.

*Terms and Conditions

Approval is conditional and subject to final review and verification. Approval, loan closing, and funding are subject to the product’s terms and conditions, and underwriting. Length of time necessary to complete the financing process, if qualified, will vary and depend on one's individual circumstances. Applications above $2.5M and certain applications below $2.5M will require further review and will not receive an instant decision. If you are applying for a loan greater than $2.5M or your initial application was in review, you will likely receive your decision in as little as 48 hours after this step. Desktop appraisal available on vacant land in MN, IL, IA, IN, OH, ND, SD, NE, MO & MI. Full appraisal required on improved property in the aforementioned states, as well as for all other states. Title work necessary in all states.

^This is a non-exhaustive list. There may be situations in which additional or updated documentation will be required.

© 2014 - 2025 Farmer's Business Network, Inc. All rights Reserved. The sprout logo, and “FBN” are trademarks, registered trademarks or service marks of Farmer's Business Network, Inc.

Financing offered by FBN Finance, LLC and its lending partners. Terms and conditions apply. To qualify, a borrower must be a member of Farmer’s Business Network, Inc. and meet all underwriting requirements. Interest rates and fees will vary depending on your individual situation. Not all applicants will qualify. NMLS ID: 1631119.

There is no guarantee of savings. Your actual savings, if any, may vary based on interest rates, the repayment terms, the amount financed, and other factors.